Bookkeeping

Popular

Description

Course Objectives

- To provide participants with a comprehensive understanding of bookkeeping principles and practices.

- To develop practical skills for maintaining accurate financial records.

- To equip learners with the knowledge required to prepare financial statements and reports.

- To introduce participants to bookkeeping tools and software.

- To ensure participants understand compliance with relevant financial regulations and standards.

Learning Outcomes

By the end of the course, participants will be able to:

- Define and explain the principles of bookkeeping and its role in business.

- Record financial transactions accurately using double-entry accounting.

- Prepare key financial statements, including income statements, balance sheets, and cash flow statements.

- Manage accounts receivable, accounts payable, and payroll processes effectively.

- Use bookkeeping software to maintain and analyze financial records.

- Identify and correct bookkeeping errors.

- Ensure compliance with financial regulations and standards.

Course Outline

Module 1: Introduction to Bookkeeping

- What is bookkeeping?

- The importance of accurate financial records

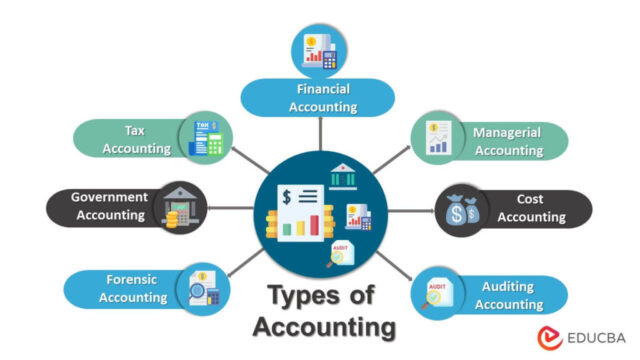

- Bookkeeping vs. accounting

- Key terminology in bookkeeping

Module 2: Fundamental Principles of Bookkeeping

- The accounting equation

- Double-entry bookkeeping system

- Debits and credits explained

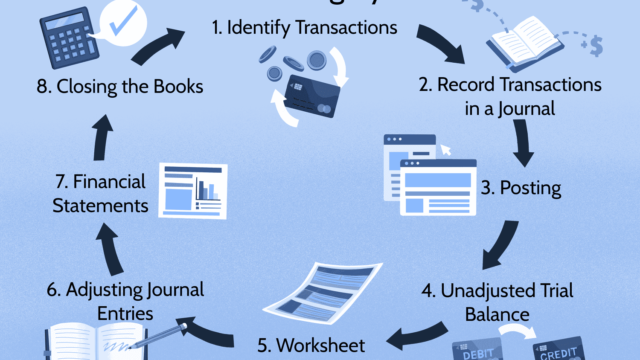

Module 3: Recording Financial Transactions

- Recording sales and purchases

- Managing cash, bank, and petty cash transactions

- Handling invoices and receipts

Module 4: Financial Statements Preparation

- Understanding income statements

- Preparing balance sheets

- Cash flow statements and their importance

Module 5: Managing Accounts

- Accounts receivable and payable

- Payroll processing and records

- Bank reconciliations

Module 6: Bookkeeping Software

- Overview of popular bookkeeping tools (e.g., QuickBooks, Xero, Wave)

- Setting up and managing accounts in software

- Generating reports using software tools

Module 7: Error Identification and Correction

- Common bookkeeping errors

- Identifying and rectifying discrepancies

- Best practices to avoid errors

Module 8: Financial Compliance and Ethics

- Understanding financial regulations and standards

- Maintaining confidentiality and integrity

- Ethical considerations in bookkeeping

Module 9: Final Project and Assessment

- Real-world bookkeeping scenario

- Prepare and present financial reports

- Peer and instructor feedback

Methodology

- Interactive Lectures:

- Introduce theoretical concepts with practical examples.

- Use slides, videos, and real-world case studies.

- Hands-On Exercises:

- Provide exercises that simulate real bookkeeping tasks.

- Use sample invoices, receipts, and financial documents.

- Software Training:

- Guided tutorials on popular bookkeeping tools.

- Practice sessions with step-by-step walkthroughs.

- Group Discussions:

- Encourage learners to share insights and discuss challenges.

- Analyze case studies collaboratively.

- Assessments:

- Regular quizzes to reinforce learning.

- Final project to demonstrate practical skills.

- Mentorship and Support:

- Provide one-on-one support sessions for learners.

- Q&A sessions to address doubts and ensure clarity.

- Supplementary Materials:

- Distribute handouts, eBooks, and reference guides.

- Provide access to recorded lectures and online resources.

Location

Review

Write a ReviewThere are no reviews yet.