Due Diligence Before Investing

Popular

Description

Course Outline: Due Diligence Before Investing

1. Introduction to Due Diligence

- Definition and importance of due diligence in the investment process.

- Key principles of thorough research and risk assessment.

- Common pitfalls of skipping due diligence.

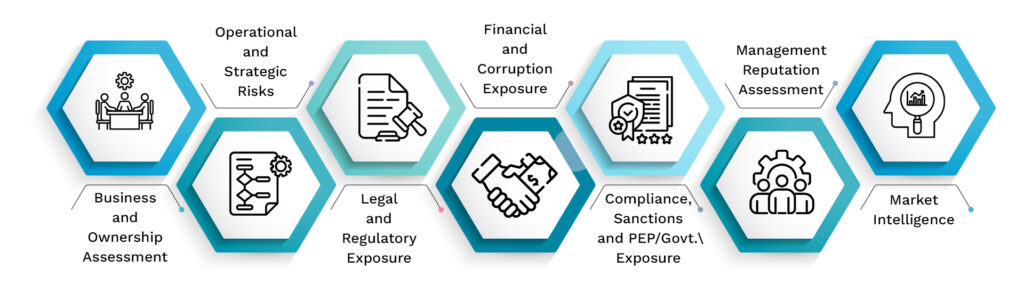

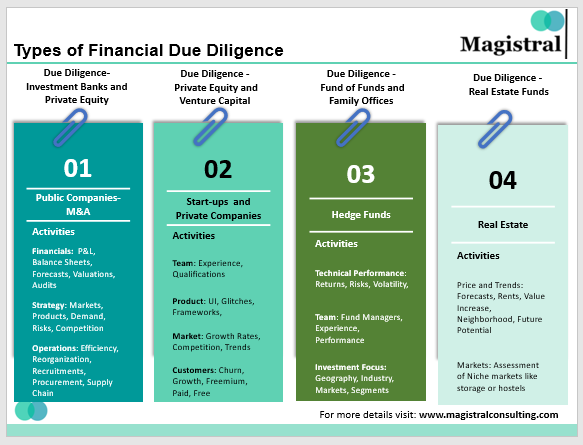

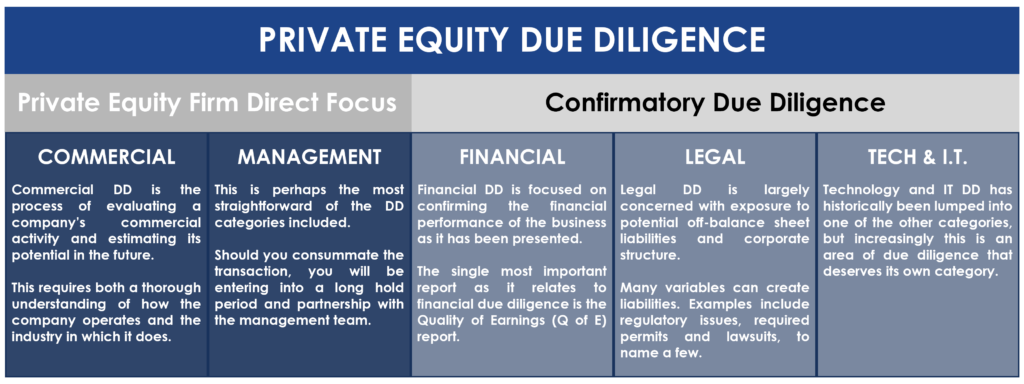

2. Types of Due Diligence

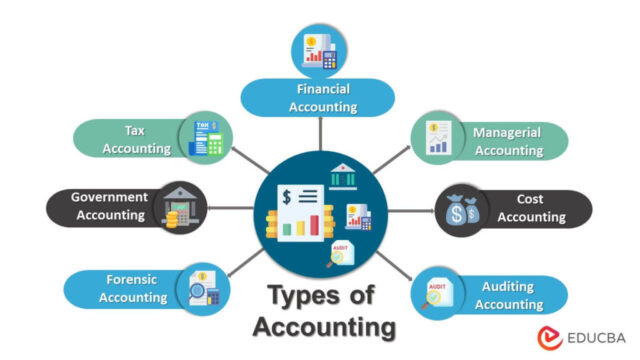

- Financial Due Diligence:

- Evaluating financial statements and ratios.

- Identifying red flags in financial records.

- Operational Due Diligence:

- Assessing the company’s operations and supply chain.

- Understanding business models and management efficiency.

- Legal Due Diligence:

- Verifying compliance with legal and regulatory standards.

- Reviewing contracts, licenses, and pending litigation.

- Market Due Diligence:

- Analyzing market position, competition, and growth potential.

- Evaluating industry trends and customer base.

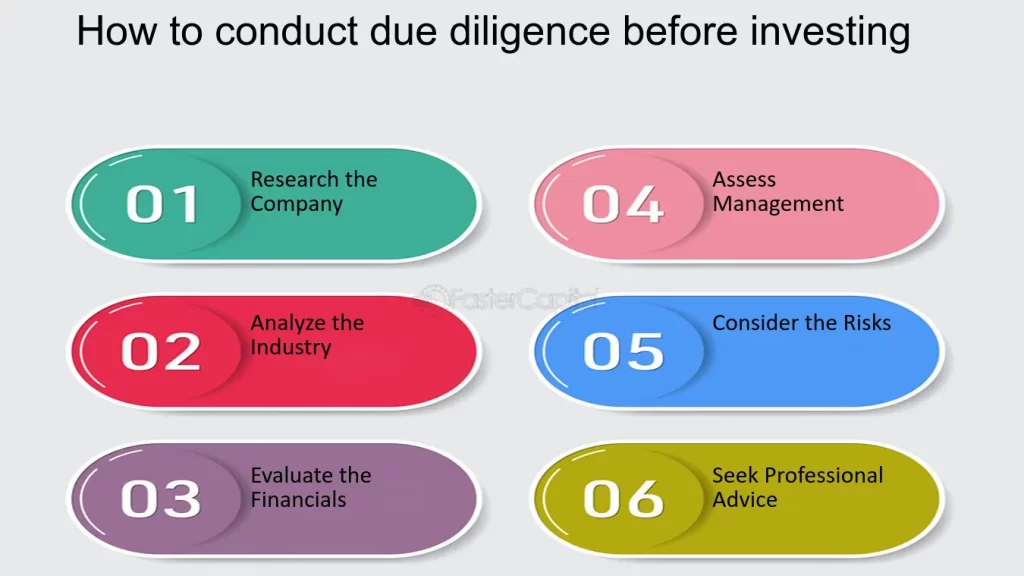

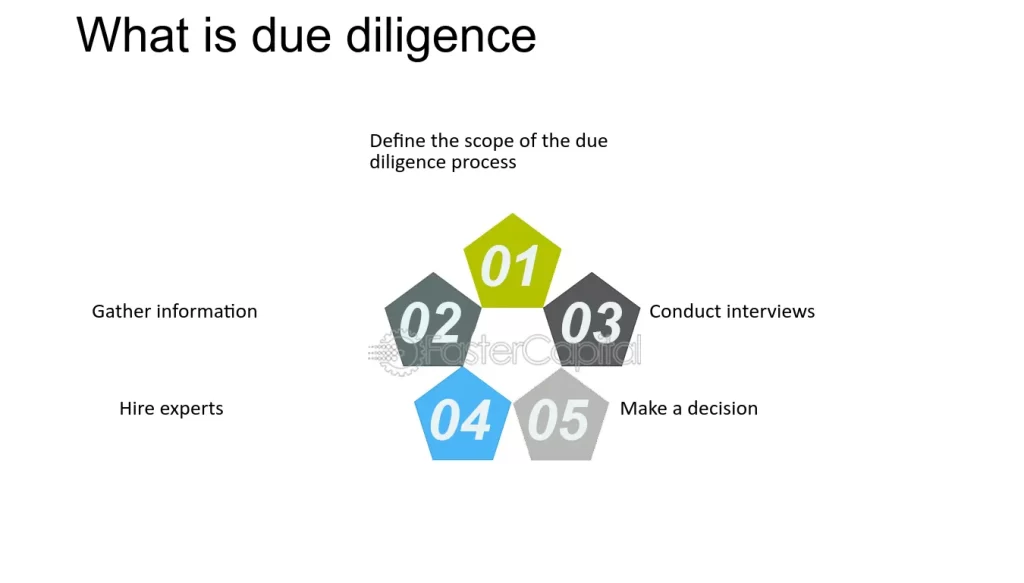

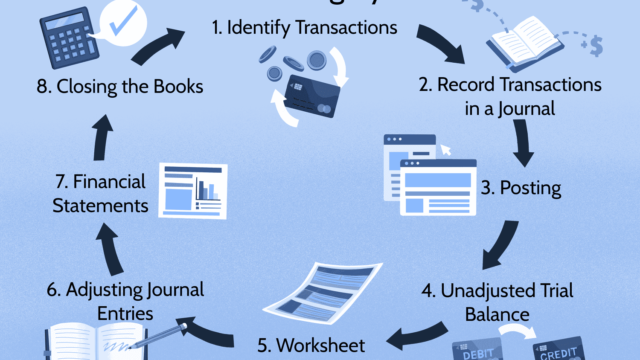

3. Steps in the Due Diligence Process

- Gathering and analyzing relevant data.

- Structuring and organizing findings into actionable insights.

- Conducting interviews with stakeholders and management.

- Preparing a comprehensive due diligence checklist.

4. Tools and Techniques for Effective Due Diligence

- Using financial analysis tools and software.

- Leveraging market research databases and tools.

- Importance of SWOT analysis in decision-making.

5. Case Studies and Real-World Applications

- Analysis of successful investments backed by robust due diligence.

- Examples of failures due to lack of or inadequate due diligence.

- Interactive group activity: Conducting a mock due diligence on a sample company.

6. Common Challenges and How to Overcome Them

- Managing incomplete or inaccurate data.

- Mitigating bias in analysis.

- Handling time constraints without compromising thoroughness.

7. Finalizing Investment Decisions

- Interpreting due diligence findings to make informed decisions.

- Balancing risk and reward based on the analysis.

- Communicating due diligence results to stakeholders.

8. Wrap-Up and Best Practices

- Key takeaways for conducting effective due diligence.

- Building a mindset of disciplined and informed investing.

- Q&A and reflection.

Objectives

- To understand the concept and significance of due diligence in investment decisions.

- To identify and evaluate critical areas of analysis during the due diligence process.

- To equip participants with tools and techniques for effective data gathering and risk assessment.

- To develop skills in interpreting findings and integrating them into investment strategies.

- To highlight common challenges in due diligence and strategies to overcome them.

Course Outcomes (Hasil Pembelajaran Kursus)

- Participants will be able to explain the importance and key elements of due diligence in investing.

- Participants will be skilled in analyzing financial, operational, legal, and market data.

- Participants will be able to identify and mitigate risks effectively through structured due diligence.

- Participants will gain hands-on experience in applying due diligence techniques to real-world scenarios.

- Participants will be equipped to make well-informed investment decisions and present findings to stakeholders confidently.

Location

Review

Write a ReviewThere are no reviews yet.