Introduction to Accounting Principles

Popular

Description

Day 1: Core Accounting Concepts and the Accounting Cycle

Morning Session (9:00 AM – 12:30 PM):

- Welcome and Course Overview

- Introduction to the course objectives and structure.

- Icebreaker activity (to understand participants’ backgrounds and goals).

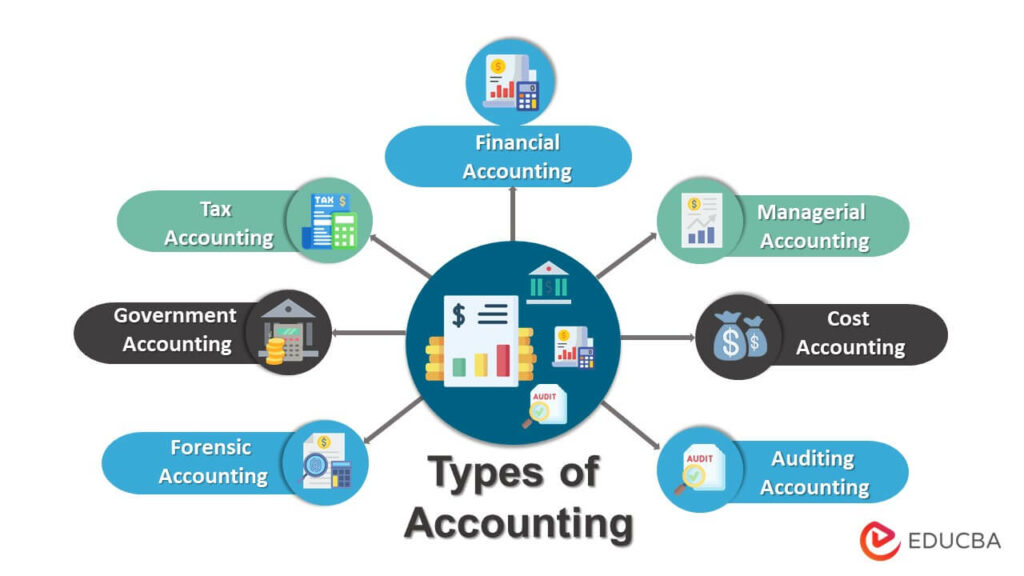

- Module 1: Basics of Accounting

- What is Accounting and its Importance?

- Key Accounting Terms and Concepts (Assets, Liabilities, Equity, Revenue, Expenses).

- The Double-Entry System: Understanding Debits and Credits.

Activity:

- Identifying and Classifying Transactions (Interactive Exercise).

Lunch Break (12:30 PM – 1:30 PM)

Afternoon Session (1:30 PM – 5:00 PM):

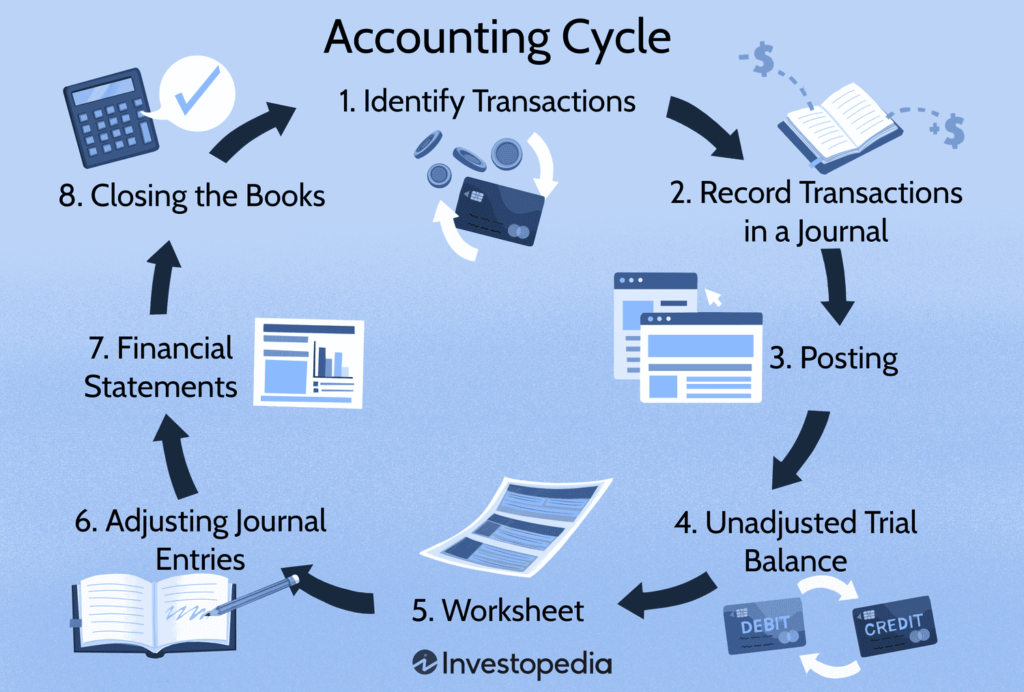

3. Module 2: The Accounting Cycle

- Recording Transactions in Journals.

- Posting to Ledgers.

- Adjusting Entries and Trial Balances.

- Hands-On Practice:

- Participants will practice journalizing and posting sample transactions to ledgers.

- Case Study:

- Completing an Accounting Cycle for a small business scenario.

Q&A and Day 1 Wrap-Up (4:45 PM – 5:00 PM)

Day 2: Financial Statements, Managerial Accounting, and Technology

Morning Session (9:00 AM – 12:30 PM):

- Module 3: Financial Statements

- Preparing and Understanding the Balance Sheet.

- Preparing and Understanding the Income Statement.

- Basics of the Cash Flow Statement.

- Activity:

- Interpreting and Analyzing Sample Financial Statements.

- Module 4: Managerial Accounting Basics

- Budgeting and Forecasting.

- Break-even Analysis and Decision-Making.

Lunch Break (12:30 PM – 1:30 PM)

Afternoon Session (1:30 PM – 4:30 PM):

4. Module 5: Technology in Accounting

- Overview of Accounting Software (QuickBooks, Xero).

- Hands-On Practice: Recording Transactions and Generating Financial Reports Using Software.

- Module 6: Ethics and Professional Standards in Accounting

- Importance of Ethical Practices.

- Discussion of Real-World Ethical Dilemmas in Accounting.

- Capstone Activity:

- Participants complete a final exercise that includes recording transactions, preparing financial statements, and analyzing financial health for a sample company.

Closing Session (4:30 PM – 5:00 PM):

- Review of Key Concepts.

- Participant Q&A.

- Feedback Session.

- Certificate Distribution and Closing Remarks.

Training Methodology:

- Interactive Presentations to explain key concepts.

- Hands-On Activities for practical application of skills.

- Group Discussions for collaboration and deeper understanding.

- Capstone Project for final assessment.

Course Objectives

By the end of this course, participants will:

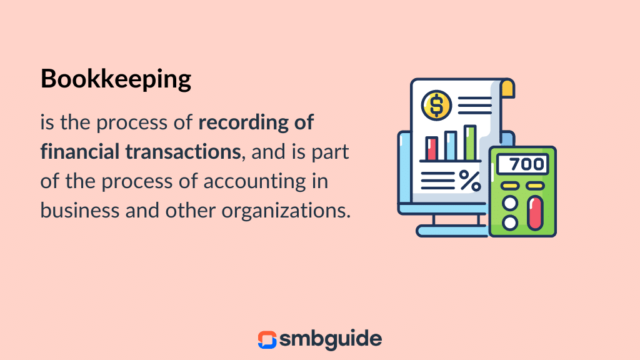

- Understand fundamental accounting principles and concepts.

- Develop the ability to analyze and record business transactions.

- Gain proficiency in preparing and interpreting financial statements.

- Understand managerial accounting basics for decision-making.

- Learn about ethical practices and professional standards in accounting.

- Familiarize themselves with technology used in modern accounting.

Learning Outcomes

Participants will be able to:

- Explain the purpose and functions of accounting in a business environment.

- Identify, record, and classify business transactions accurately.

- Prepare key financial statements and analyze their components.

- Apply basic cost accounting techniques to support business decisions.

- Utilize accounting software to manage financial data effectively.

- Recognize and adhere to ethical standards in accounting practice.

Location

Review

Write a ReviewThere are no reviews yet.